Contrarian in action: Tucano Gold takes over Great Panther's Tucano mine in Brazil

Jeremy Gray, CEO of private gold companies Pilar Gold and Laiva Gold, has done it again – for the third time. The acquisition of Equinox’s Pilar Mine in Brazil (April 2021) and Laiva Mine in Finland (October 2022) is now followed by the biggest deal to date: the acquisition of Great Panther’s former flagship project, Mina Tucano Mine, by the newly formed Tucano Gold, again in Brazil. The logic is always the same in all deals. In best contrarian fashion, Gray and his group are using the doldrums in the gold market as an opportunity to acquire financially distressed production-ready gold assets, complete with infrastructure and permits, for a fraction of their replacement value.

The private group’s advantage over listed competitors is its ability to make quick decisions. Jeremy Gray likes to refer to his portfolio companies as the “fastest growing group of gold companies that nobody knows about yet.” That is likely to change if the three related but independent companies, Pilar, Laiva and Tucano, actually manage to produce a combined 300,000 ounces per year by the end of 2024. With such a performance, Tucano, Laiva and Pilar, or even a sensible combination of these companies, should undoubtedly prove to be attractive stock market candidates. Even more so in a strong gold environment. Jeremy has a catchy image for this too: you play cricket in the summer, not in the winter.

Figure 1: Mina Tucano’s plant with a capacity of 10,000 tonnes per day – Amapá state, Brazil

In the specific case of Tucano, the takeover, including legal fees, costs around USD 4 million. The replacement value of the mine, including infrastructure, is likely to be hundreds of millions of dollars. The mill at the project is the second largest gold processing plant in all of Brazil, with a capacity of 10,000 tonnes per day. The operation includes a state-of-the-art CIL plant with a capacity of 3.5 million tonnes per year, which produced an average of 134,000 ounces per year from 2014 to 2020. In 2020, Mina Tucano generated EBITDA of over US$80 million. In 2022, the mine produced 60,000 ounces in the first 9 months before unexpectedly ceasing operations.

According to a 43-101 report updated by Great Panther on 8 June 2022, the mine has proven and probable reserves of 12.9 million tonnes at 1.59 g/t for 656,000 ounces. The M,I & I resource is 1.8 million ounces with significant room for expansion. The associated land package alone covers an area of 90 x 30 km outside the immediate mining operations. More than 90 per cent of creditors formally approved the change of ownership in court on 15 September.

Tucano creditors agreed to halve their claims

The creditors were prepared to agree to a dramatic cut of 40 to 50 percent in their claims. Only by operating the mine can they hope that their remaining claims will be serviced in the long term. The new owner Tucano Gold was also granted generous deadlines for the payment of the remaining claims amounting to around USD 60 million. The payment holiday for Creditors is 3 years. But it is also about securing about 1,000 jobs. As early as next year, Mina Tucano wants to be the largest employer in the Brazilian state of Amapá again.

Gray and his Pilar Group have earned a reputation as deal-makers and restructurers in Brazil and beyond, especially in the past two years. At the Pilar project, the team there is proving that it is possible to successfully run an underground mine with gold grades averaging only 1 g/t – despite inherited defects and legacy issues. Respect for the high competence of the Pilar team should reliably be one of the trump cards in negotiations with creditors. This certainly also applies to the spectacular takeover of Europe’s largest gold processing plant Laiva in Finland. Its creditors, including a Blackrock fund, are now Pilar shareholders. The restart of the Laiva mine is planned for next spring.

Tucano production to start as early as November 2023 – first underground mining in 2024

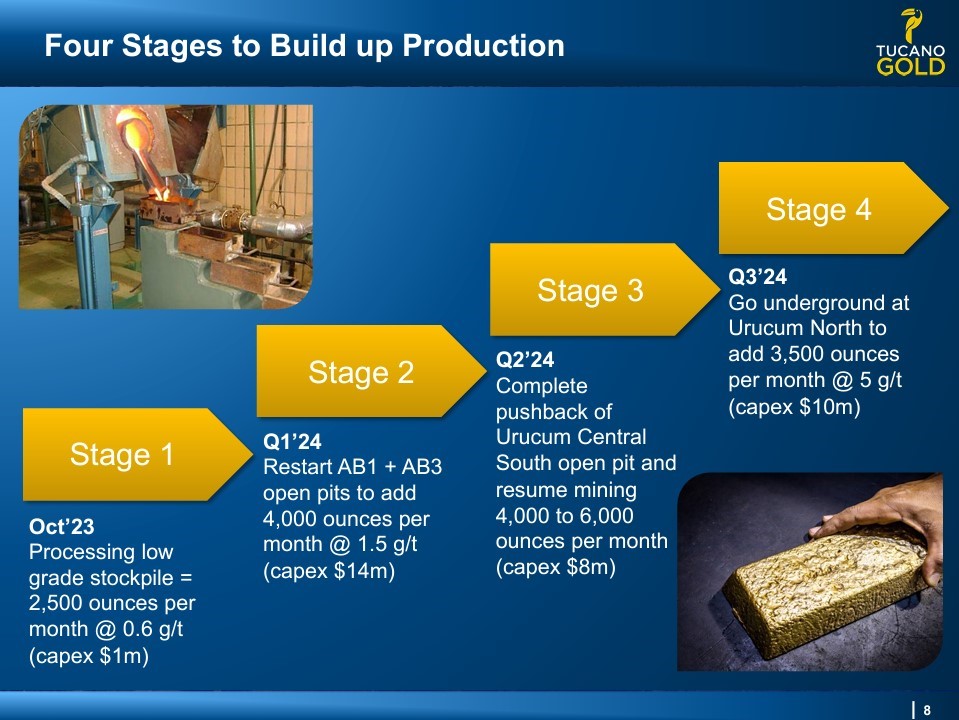

The Tucano mine is scheduled to resume production in stages as early as November this year. For the first time in the mine’s history, underground production is planned for 2024. The extensive experience of the Pilar team should be particularly helpful here, especially as the underground ore body at Tucano has average grades of 5 g/t, many times higher than Pilar’s values.

Figure 2: Tucano plans to re-enter production in four stages. Underground mining is expected to begin from the end of 2024.

The subscription period for the seed round ends on Friday 13 October 2023

Due to strong investor interest, Tucano Gold has decided to increase the capital raise to C$10 million at $0.50/share. This offering is priced at a post-funding valuation of only ~C$20m. At the same time, Tucano Gold is expected to start operations with cash on hand of approximately US$10m. Investors in this round of Tucano Gold will also benefit from the planned spin-off of Tucano Exploration in 2024. Tucano Exploration will own arguably the largest and most prospective properties of any junior explorer on the Guyana Shield around the Tucano Mine. The subscription period for the seed round is expected to close on Friday, October 13, 2023.

More Information here: http://eepurl.com/izRS4-/

Disclaimer: GOLDINVEST Consulting GmbH publishes comments, analyses and news on https://goldinvest.de. These contents serve exclusively the information of the readers and do not represent any kind of call to action, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. Furthermore, they do not in any way replace individual expert investment advice and do not constitute an offer to sell the stock(s) discussed or a solicitation to buy or sell securities. This is expressly not a financial analysis, but an advertising / journalistic text. Readers who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. There is no contractual relationship between the GOLDINVEST Consulting GmbH and its readers or the users of its offers, because our information refers only to the company, but not to the investment decision of the reader.

The acquisition of securities involves high risks, which can lead to a total loss of the invested capital. The information published by GOLDINVEST Consulting GmbH and its authors is based on careful research. Nevertheless, any liability for financial losses or the content guarantee for topicality, correctness, adequacy and completeness of the articles offered here is expressly excluded. Please also note our terms of use.

According to §34b WpHG and § 48f Abs. 5 BörseG (Austria) we would like to point out that GOLDINVEST Consulting GmbH and/or partners, principals or employees of GOLDINVEST Consulting GmbH hold shares of Tucano Gold and therefore a conflict of interest exists. GOLDINVEST Consulting GmbH also reserves the right to buy or sell shares of the company at any time. Furthermore, GOLDINVEST Consulting GmbH is remunerated by Tucano Gold for reporting on the company. This is another clear conflict of interest.