As US fashion companies diversify their sourcing from Asia, near-sourcing from the Western Hemisphere, particularly members of the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) seems to benefit. According to the latest trade data from the Office of Textiles and Apparel (OTEXA), US apparel companies placed relatively more sourcing orders with suppliers in the Western Hemisphere in 2021. For example, CAFTA-DR members’ market shares increased by 0.31 percentage points in quantity and nearly one percentage point in value compared with a year ago.

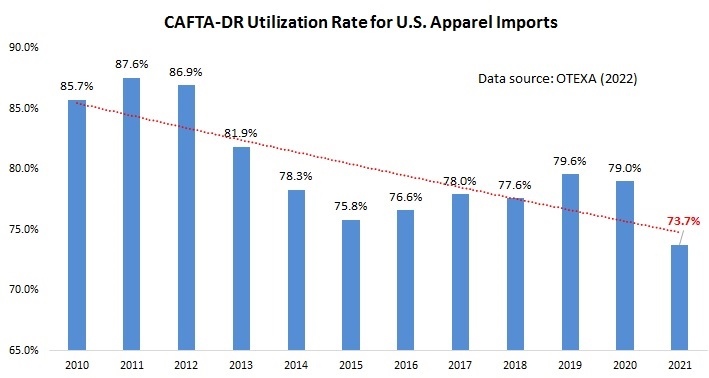

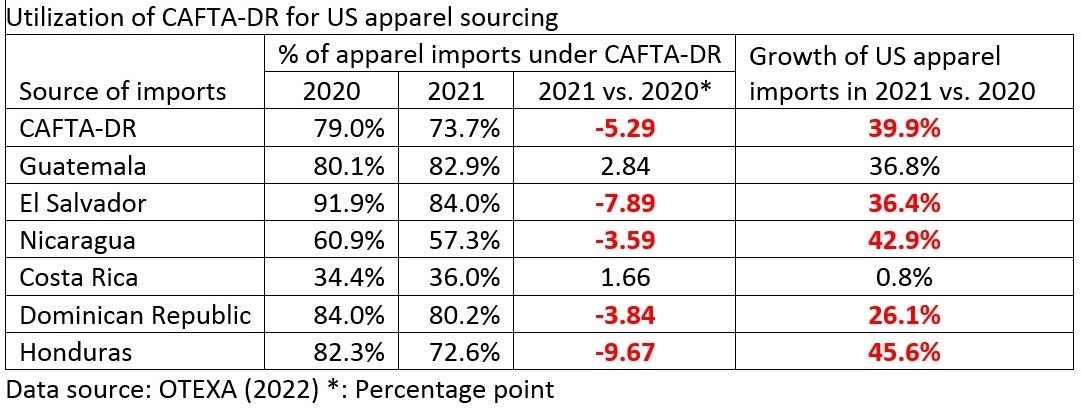

However, it is concerning to see the utilization rate of CAFTA-DR for apparel sourcing fall to a new record low of only 73.7% in 2021. This means that as much as 26.3% of US apparel imports from CAFTA-DR members did NOT claim the duty-free benefits.

The lower free trade agreement (FTA) utilization rate became a problem, particularly among CAFTA-DR members with fast export growth to the US market in 2021. For example, whereas US apparel imports from Honduras enjoyed an impressive 45.6% growth in 2021, only 72.6% of these imports claimed the CAFTA-DR duty benefits, down from 82.3% a year ago. We can observe a similar pattern in El Salvador, Nicaragua, and the Dominican Republic.

The phenomenon is far from surprising, however. For years, US fashion companies have expressed concerns about the limited textile supply within CAFTA-DR, especially fabrics and textile accessories. The lack of textile supply plus the restrictive “yarn-forward” rules of origin in the agreement often creates a dilemma for US fashion companies: either source from Asia entirely or source from CAFTA-DR but forgo the duty-saving benefits.

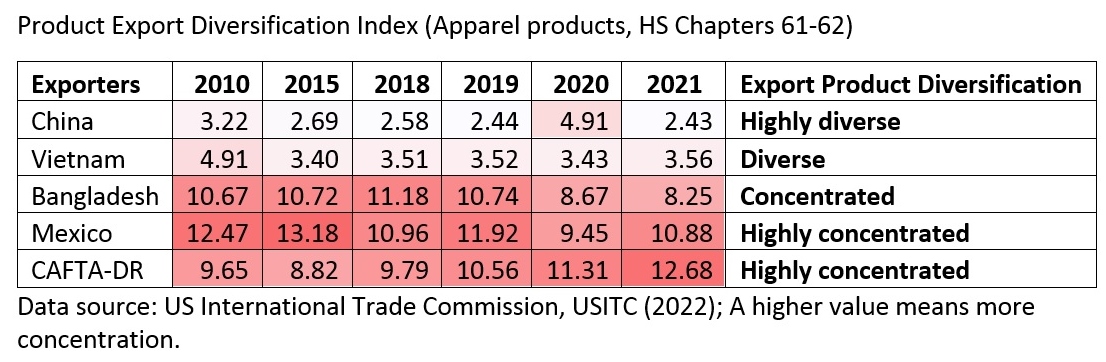

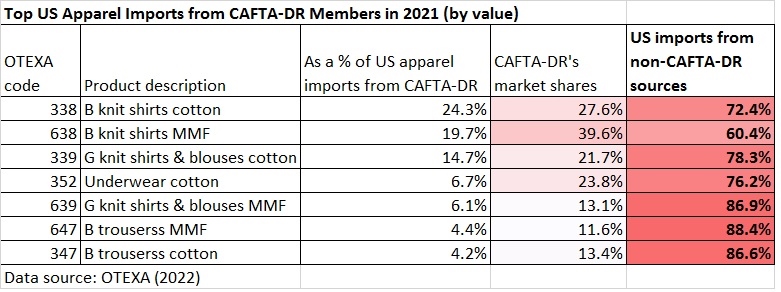

Likewise, because of a lack of sufficient textile supply within the region, US apparel imports from CAFTA-DR members become increasingly concentrated on basic fashion items, typically facing intense competition with many alternative sourcing destinations. For example, measured in value, over 80% of US apparel imports from CAFTA-DR members in 2021 were shirts, trousers, and underwear. However, US companies import the vast majority (70%-88%) from non-CAFTA-DR sources for these product categories.

Understandably, it will be unlikely to substantially expand US apparel sourcing from CAFTA-DR members without solving the textile supply shortage problem facing the region.

More reading:

Very interesting article. An obvious reason why the number was so low in 2021 is the coronavirus crisis that began in 2020. It disrupted many key aspects of the apparel trade industry and many countries suffered economically as well. It is important that the US continues to expand and diversify their sourcing but also acknowledge the shortage problem CAFTA-DR sources are facing.

Considering how the benefits of CAFTA-DR are great for brands, it is interesting to see brands not utilizing this free trade agreement. This is not a good thing because it means the US apparel industry is sourcing from non CAFTA-DR regions. The largest reasoning for this is the conservative rules under yarn-forward. CAFTA-DR has great benefits however it does not give the US fashion companies a lot of options for their supply chain. If the rules were to change to the more liberal fabric forward, more fashion brands would use CAFTA-DR members for their supply chain for the benefits. US apparel brands would love this change because they would have more options including less expensive options which allows brands to keep their prices low. However, the US textile industry will fight this change because it will take business away from them. I believe that if this rule were to change there would be more participants in CAFTA-DR and brands claiming the duty free benefits. This would lead to the percentage of CAFTA-DR utilization rates to go up instead of continuing to go down.

US fashion companies also call for easier use of mechanisms such as the short supply list. see here: https://www.newsweek.com/updating-cafta-dr-can-mitigate-migration-crisis-opinion-1683475

However, the US textile industry rejects the idea:http://www.ncto.org/independent-study-highlights-benefits-of-u-s-cafta-dr-agreement-and-devastating-impact-of-weakening-agreements-rules/?utm_source=rss&utm_medium=rss&utm_campaign=independent-study-highlights-benefits-of-u-s-cafta-dr-agreement-and-devastating-impact-of-weakening-agreements-rules

In theory, the free trade agreement with CAFTA-DR is an ideal solution to revive the Western hemisphere’s textile and apparel industry. As the article states above, while the US has imported more apparel products from this region, the percentage of these imports that qualify for duty-free benefits has decreased. We can partly attribute the restrictive yarn-forward rules to this phenomenon; however, if CAFTA-DR mills and manufacturers do not have the production resources to support the volume of US orders, the restriction of yarn-forward rules becomes a mute factor. Regardless of yarn-forward or fabric-forward, US companies will be forced to source elsewhere, whether it be in search of lower costs or greater capabilities. The real question here is: how can CAFTA-DR textile and apparel manufacturers make themselves more attractive to US companies? In other words, we must analyze how to shift the supply chain to ensure that CAFTA-DR has the capacity, skill, and resources to support the production demands of US companies.

The decreased rate of utilization rates of CAFTA-DR is very thought provoking. It will be interesting to see if restrictions will be lifted to promote higher levels of this trade deal. If brands and retailers are forgoing doing business within this region, it is ultimately driving profits outside of the country. This is a big problem for policymakers that are pushing for more in house production and sourcing from the US textile industry. Another idea that could be implemented to solve this issue is investing resources and technology outside of the country to be able to produce fibers and textiles that are limited within these regions. This would keep companies inside of the CAFTA-DR region instead of driving them to other hemispheres looking for the particular textiles they need. This would also create an influx of companies that will take advantage of the duty saving benefits. Possibly targeting this lack of particular fibers and textiles will bring the utilization rates higher and allow companies to take better advantage of the trade deals set in place.

Good analysis. As you may notice, because the US textile industry resists any changes to the CAFTA-DR rules of origin, they never mention the shortcomings of the agreement and problems like the FTA underutilization.

I was intrigued to learn about the decrease in utilization of the CAFTA-DR region in recent times. It is disheartening to note that nearly a quarter of the region is missing out on the duty-free benefits that could boost their economic growth. Upon further examination, it appears that one of the reasons for this underutilization could be the stringent conditions of the yarn forward rule, which imposes strict guidelines on the origin of the yarn used in the production of garments.

In my opinion, policy makers should seriously consider relaxing these rules to allow for a more optimal utilization of the trade agreement. Additionally, the fact that the CAFTA-DR region specializes in simple garments such as shirts, pants, and underwear also doesn’t bode well for their competitiveness, as the U.S imports 80% of these items from outside of the CAFTA-DR region.

To address this issue, a more comprehensive approach that considers the specific needs and strengths of the CAFTA-DR region would be more beneficial. The region has a wealth of untapped potential, and with the right policies and initiatives in place, it could significantly contribute to the growth and development of the global economy.

In conclusion, it is imperative that we address the challenges facing the CAFTA-DR region and work towards creating a more inclusive and equitable global trade system. By doing so, we can ensure that all regions have the opportunity to reach their full potential and contribute to the greater good of humanity.